Real Estate Reno Nv Can Be Fun For Anyone

Table of ContentsThe Greatest Guide To Real Estate Reno NvIndicators on Real Estate Reno Nv You Should KnowTop Guidelines Of Real Estate Reno NvNot known Facts About Real Estate Reno Nv

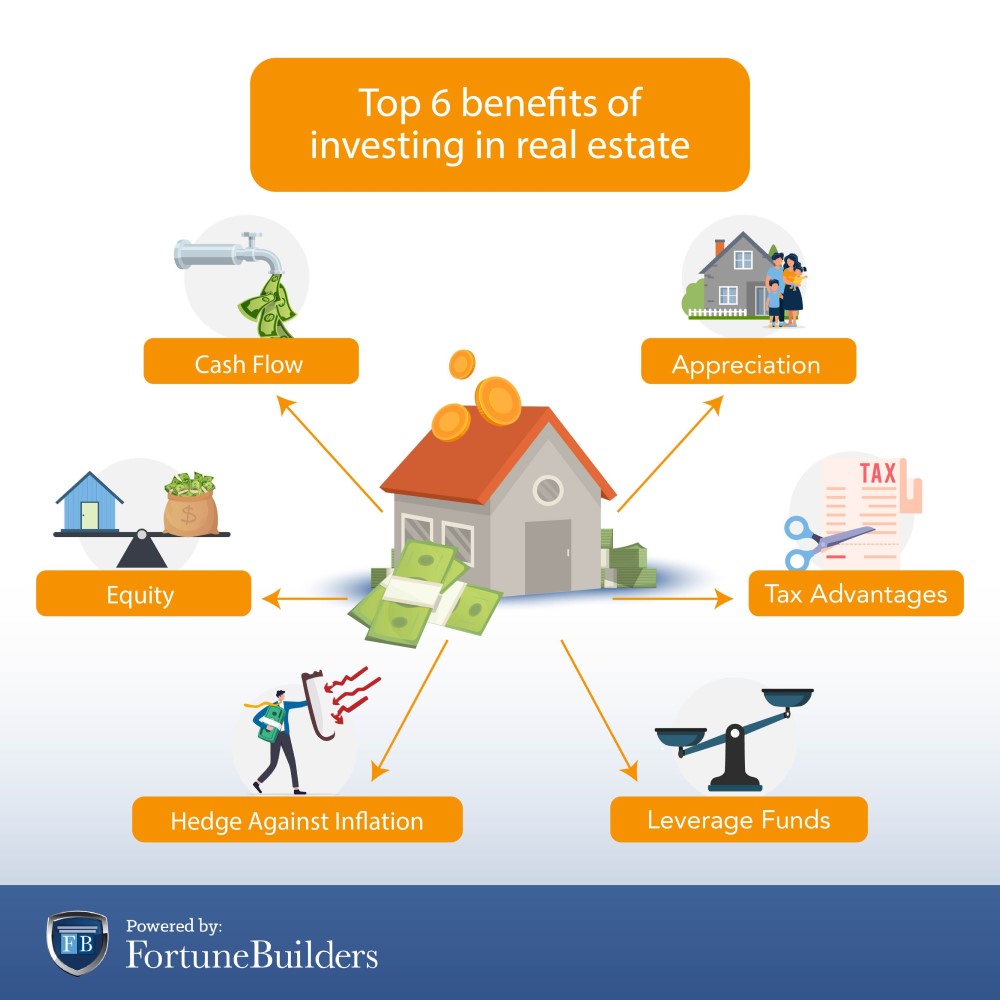

That may show up pricey in a world where ETFs and mutual funds might bill as low as zero percent for building a diversified profile of supplies or bonds. While platforms may vet their investments, you'll have to do the very same, which suggests you'll require the skills to analyze the possibility.Like all financial investments, real estate has its pros and cons. Long-lasting admiration while you live in the building Prospective hedge versus inflation Leveraged returns on your financial investment Passive earnings from rental fees or with REITs Tax benefits, consisting of interest reductions, tax-free funding gains and devaluation write-offs Dealt with long-lasting funding readily available Appreciation is not guaranteed, especially in economically clinically depressed locations Home costs may drop with greater passion prices A leveraged financial investment means your down repayment is at risk May call for significant time and cash to manage your own buildings Owe an established home mortgage settlement every month, also if your occupant doesn't pay you Lower liquidity for actual property, and high payments While actual estate does supply lots of advantages, particularly tax advantages, it does not come without considerable drawbacks, in certain, high commissions to exit the market.

Do you have the resources to pay a mortgage if a renter can not? Just how much do you rely on your day job to maintain the financial investment going? Determination Do you have the desire to serve as a proprietor? Are you ready to collaborate with tenants and recognize the rental regulations in your location? Or would you favor to evaluate offers or investments such as REITs or those on an on-line system? Do you wish to satisfy the demands of running a house-flipping organization? Understanding and abilities While numerous financiers can learn at work, do you have special abilities that make you better-suited to one kind of financial investment than one more? Can you analyze stocks and create an appealing profile? Can you repair your rental property or take care of a flipper and save a bundle on paying specialists? The tax benefits on realty vary widely, depending on just how you invest, yet purchasing genuine estate can offer some substantial tax advantages. Real Estate Reno NV.

The Definitive Guide to Real Estate Reno Nv

REITs use an eye-catching tax obligation account you will not sustain any type of funding gains taxes useful link until you sell shares, and you can hold shares literally for decades to stay clear of the tax obligation male. You can pass the shares on to your beneficiaries and they won't owe any taxes on your gains (Real Estate Reno NV).

Realty can be an eye-catching financial investment, yet financiers desire to make sure to match their kind of investment with their determination and ability to manage it, including time dedications. If you're aiming to produce earnings during retirement, property investing can be one means to do that.

There are a number of benefits to purchasing actual estate. Constant revenue circulation, strong returns, tax see this obligation benefits, diversity with well-chosen properties, and the ability to utilize wealth via real estate are all benefits that financiers may delight in. Here, we look into the numerous advantages of buying property in India.

Not known Details About Real Estate Reno Nv

Property tends to value in worth over time, so if you make a wise financial investment, you can profit when it comes time to offer. With time, rents likewise often tend to enhance, which may raise capital. Rents boost when economic climates expand because there is more need for real estate, which increases resources worths.

If you are still working, you may maximise your rental earnings by spending it following your monetary goals. There are numerous tax advantages to genuine estate investing.

5 lakh on these details the principle of a mortgage. In a similar capillary, area 24 permits a decrease in the needed rate of interest repayment of up to Rs 2 lakhs. It will dramatically lower taxed earnings while reducing the cost of realty investing. Tax obligation reductions are offered a range of costs, such as firm costs, money flow from various other possessions, and home loan interest.

Property's link to the various other primary asset teams is breakable, at times also unfavorable. Property might therefore decrease volatility and boost return on danger when it is consisted of in a portfolio of numerous possessions. Contrasted to other properties like the stock exchange, gold, cryptocurrencies, and financial institutions, purchasing property can be dramatically much safer.

8 Simple Techniques For Real Estate Reno Nv

The supply market is continuously changing. The realty sector has actually expanded over the past several years as a result of the application of RERA, lowered home mortgage rate of interest, and other aspects. Real Estate Reno NV. The rate of interest on bank interest-bearing accounts, on the various other hand, are low, especially when contrasted to the rising inflation